Facebook, Meta Platforms, Inc. has changed the way the world interacts and communicates. It is one of the biggest social media sites, and its financial standing provides key indicators of the state of digital advertising and consumer habits. This article discusses Facebook’s earnings and goes into great detail about historical trends, types of revenue, problems, and future outlook.

Historical Earnings Performance

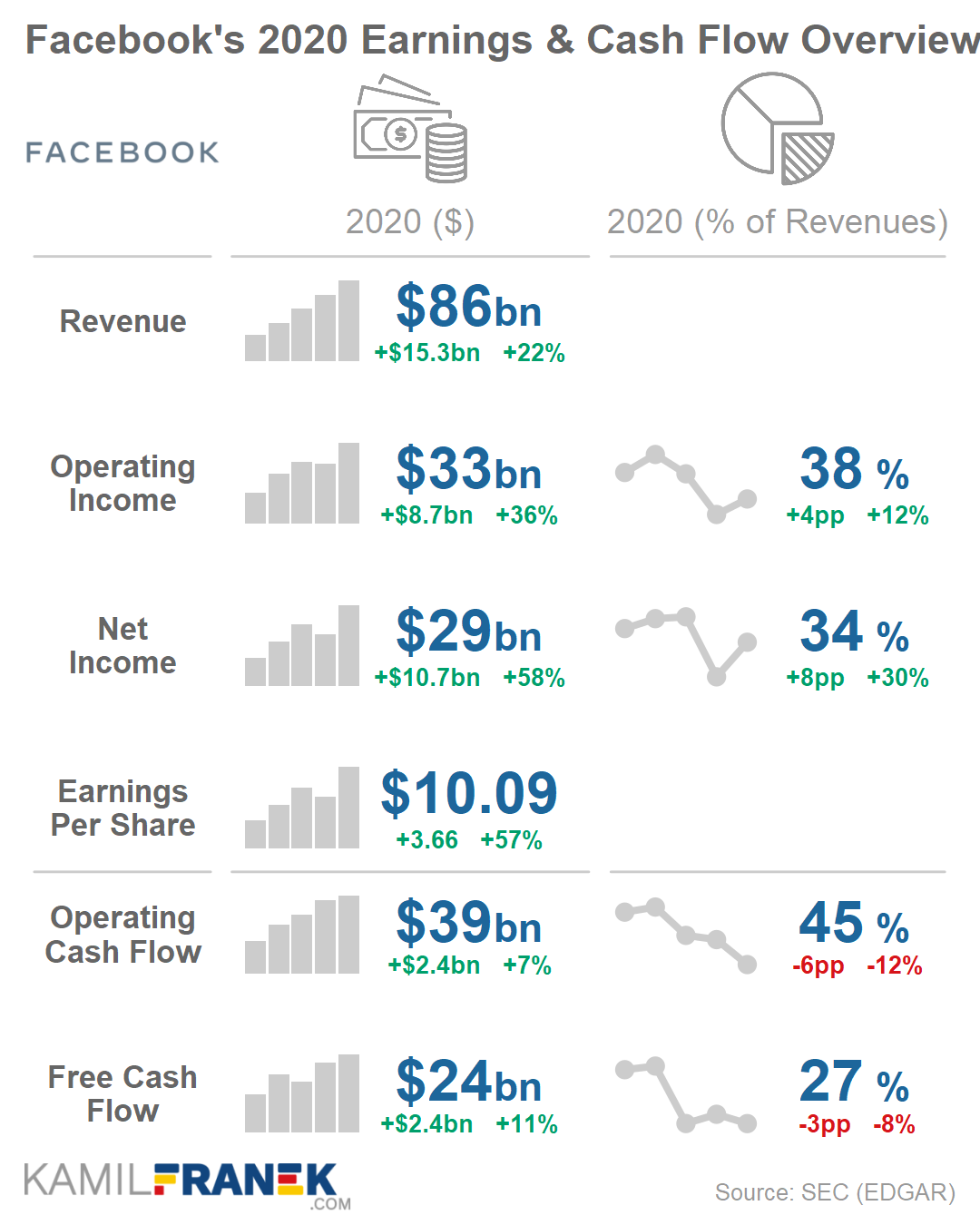

Ever since it went public in 2004, Facebook has continued to show strong revenue growth, mainly due to its advertising services. The company’s revenue soared from 117 billion in 2022. This path not only demonstrates Facebook’s power over the social media sphere but also how it has been able to change and grow in a very dynamic market.

Investors have relied on the quarterly earnings reports to give them a sense of how things are going, such as user engagement trends, ad spending, and overall financial stability. When it comes to FB’s earnings reports over the last few years, the one thing that has really stood out are the large revenue numbers, which most of the time are higher than what the analysts have expected. For example, it brought in $32 billion in Q1 2022 (yes, that is billion with a B) which shows a year-over-year growth rate that proves it is not only standing strong against competition but also against.

Revenue Sources

Facebook’s earnings can be dissected into several primary revenue sources:

- Advertising Revenue: This is the cornerstone of Facebook’s business model. With over 2.9 billion monthly active users, the platform provides advertisers with unparalleled access to a diverse global audience. The company’s advertising model relies on sophisticated targeting algorithms, enabling businesses to reach specific demographics based on user behavior, interests, and location. This targeted approach not only enhances ad effectiveness but also maximizes return on investment for advertisers.In recent years, Facebook has diversified its ad offerings, introducing video ads, carousel ads, and Instagram Shopping features. These innovations have attracted a broader range of advertisers, from small businesses to multinational corporations.

Other Revenue Streams: Although advertising still seems to be the most prevelant, Facebook has expanded into other areas of revenue. The oculus branch, which deals with virtual reality (vr) products, has been growing in demand and sales, especially now that vr is becoming more accessible. Facebook Shops and Marketplace, which are also new, further illustrates the company’s investment in e-commerce, where businesses can establish online stores right on the platform.

Subscription Services: Facebook has tinkered with subscription-based services, but this still only represents a small fraction of total revenue. That would include user-friendly additions like no-ad browsing or special content.

Key Financial Metrics

There are a few major indicators that one must examine to determine the fiscal status of Facebook.

Revenue Growth: The year over year revenue growth is one of the most important sign for Facebook. There have been some ups and downs due to the economy and other companies, but overall the company has seen steady growth. But the last few quarters have shown slower growth which is indicative of more competition and a changing market place.

Profit Margins: Facebook has historically enjoyed high profit margins due to its relatively low operational costs compared to its revenue. Which in turn has allowed the firm to pour a lot of money back in to research and development and also in to new technological advances and user friendly attributes to stimulate user activity.

User Engagement: Active user metrics are directly tied to advertising revenue. Keeping and expanding its user base is everything for facebook. However, although there are new competitors like TikTok, Facebook still reports very high user engagement which is very important because it keeps advertising dollars coming in.

.

Challenges Facing Facebook

Despite its successes, Facebook faces several challenges that could impact its earnings:.

Regulatory Scrutiny: Facebook is being investigated by governments everywhere for privacy, data protection, and antitrust. This regulatory climate can expose the company to some serious risk of fines or operational changes that could hurt profitability.

Competition: But the growing popularity of other platforms, notably TikTok, has made the field for ad dollars even more competitive. But younger audiences are being drawn to these newer sites and if it continues facebook will lose user interest. The company must always be innovating to keep its audience and to attract advertisers.

Economic Factors: Broader economic conditions significantly affect advertising budgets. In times of economic recession, companies tend to spend less on marketing, which could in turn hurt Facebook’s ad revenue. And then there’s the question of the state of the world’s economy–especially in the wake of the pandemic.

Public Perception and Trust: Facebook has been controversial because of the data privacy issues, the misinformation that is spread, and the mental health effects that it has. Negative public image would mean less usage and less advertising, since companies wouldn’t want to be associated with something that everybody is shitting on.

Future Outlook

Speaking of the future, Facebook is betting heavily on the metaverse, which is essentially a virtual world where people would be able to experience and interact with each other in 3D immersive environments. This is a very aggressive move to try and capitalize on future shopping habits and create new cash flows. The metaverse could transform how users engage with digital content, providing opportunities for virtual events, shopping experiences, and more.

https://www.facebook.com/?_rdc=1&_rdr

However, the metaverse also involves substantial risks and costs. The technology is still fairly new, and it will be a while before it becomes commonplace. Also, the VR and AR arena is heating up with a lot of big tech companies trying to dominate.

That and of course continuous innovation in advertising and e-commerce will be a must in order to sustain growth. User experience, ad targeting, and revenue stream diversification will all be focus points for facebook as it tries to adapt in this quickly changing world.

Conclusion

Facebook’s earnings are a good indicator of the pulse of the online advertising world and provide a window into consumer habits. Although the company has posted strong profits every quarter, it must still maneuver through a minefield of competition, regulatory hurdles, and shifting consumer tastes. Facebook faces a future of opportunities and dangers in order to keep its power and be flexible enough to change in a world that is constantly changing. Investors, advertisers, and users alike will be closely watching how the company capitalizes on new technologies and trends while addressing the challenges that lie ahead.